Everything You Need to Know About Retirement Policy

Planning for retirement is a critical aspect of long-term employee security. A Retirement Policy outlines eligibility, benefits, and transition procedures, ensuring employees understand their options and HR teams can manage retirements smoothly.

What is a Retirement Policy?

A Retirement Policy is an HR document that outlines the procedures, eligibility criteria, and benefits for employees retiring from the organization. It covers retirement age, pension plans, 401(k) contributions, transition planning, and post-retirement benefits.

A clear retirement policy helps employees prepare for their future while ensuring a smooth transition for both the individual and the company.

Guidelines for Creating a Retirement Policy

A clear retirement policy supports employees in transitioning from work to retirement while maintaining compliance with legal standards. Here are some guidelines to consider:

Define Retirement Eligibility

Specify age or years of service requirements for voluntary or mandatory retirement.

Outline Retirement Benefits

Detail pension plans, 401(k) contributions, company-sponsored savings, and additional perks.

Communicate Transition Support

Provide counseling, phased retirement options, and knowledge transfer programs.

Address Legal Compliance

Ensure compliance with labor laws, social security, and retirement fund regulations.

Encourage Early Planning

Offer resources and financial planning workshops for retirement readiness and budgeting.

Support Employees with Retirement Workshops

Conduct periodic training sessions to help employees prepare financially and emotionally for retirement.

What is Covered in a Retirement Policy?

An effective Retirement Policy should include the following:

Retirement Age and Eligibility

Define the minimum age or years of service required for standard and early retirement options.

Pension and Savings Plans

Outline company-sponsored savings plans, pensions, and 401(k) contributions with employer matching.

Early Retirement Options

Address voluntary early retirement, buyout packages, and associated financial considerations.

Retirement Transition Assistance

Offer phased retirement programs, consulting opportunities, and knowledge-sharing initiatives.

Health Benefits Post-Retirement

Specify continued health insurance options, Medicare eligibility, and supplemental plans.

Rehiring Retired Employees

Establish guidelines for re-engagement, including part-time or contract-based employment opportunities.

Financial and Emotional Preparedness

Provide training sessions and resources to help employees manage post-retirement finances and lifestyle changes.

Need help creating a Retirement Policy?

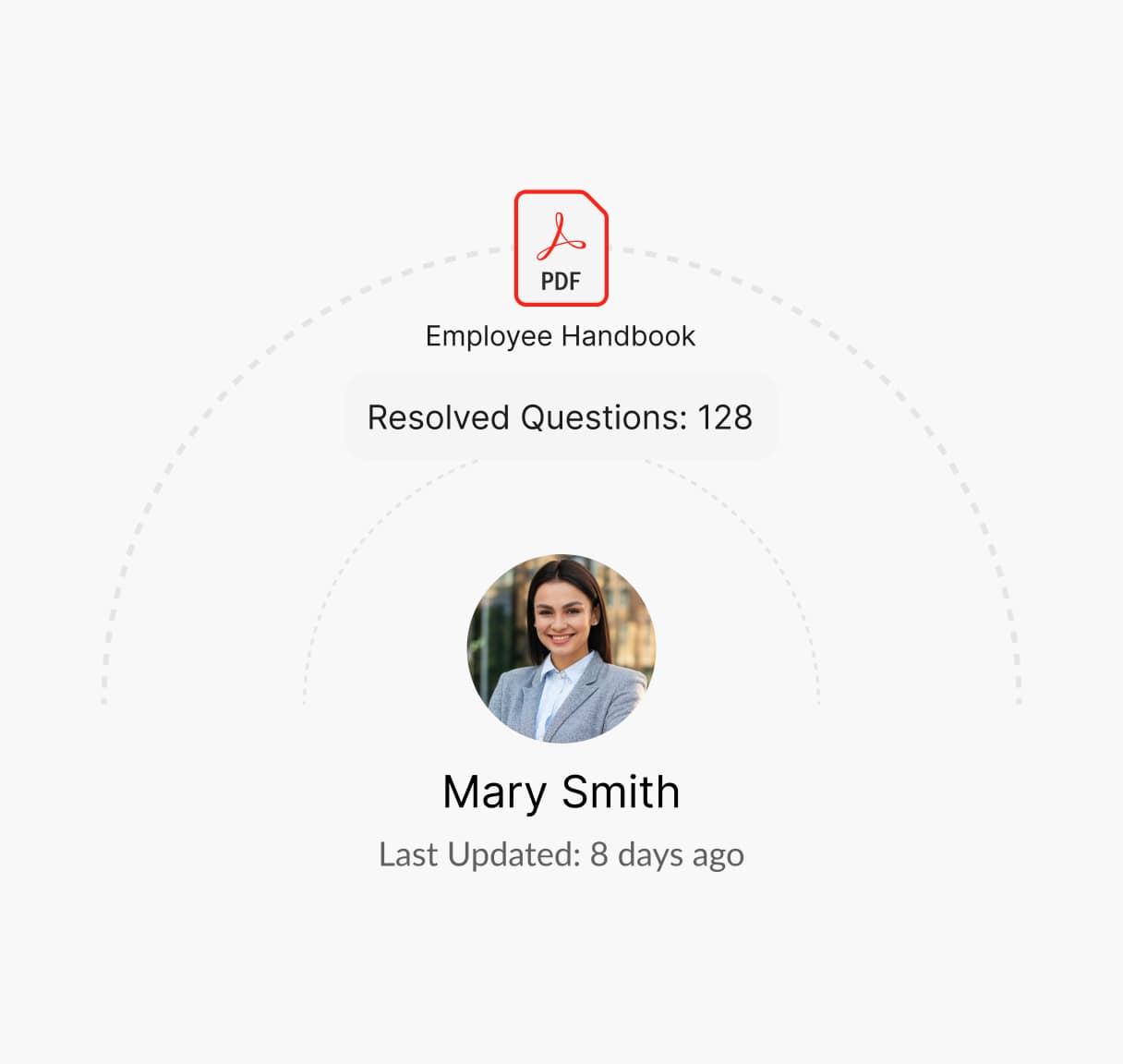

How Winslow helps HR pros save time on responding to Retirement Policy- Related Queries

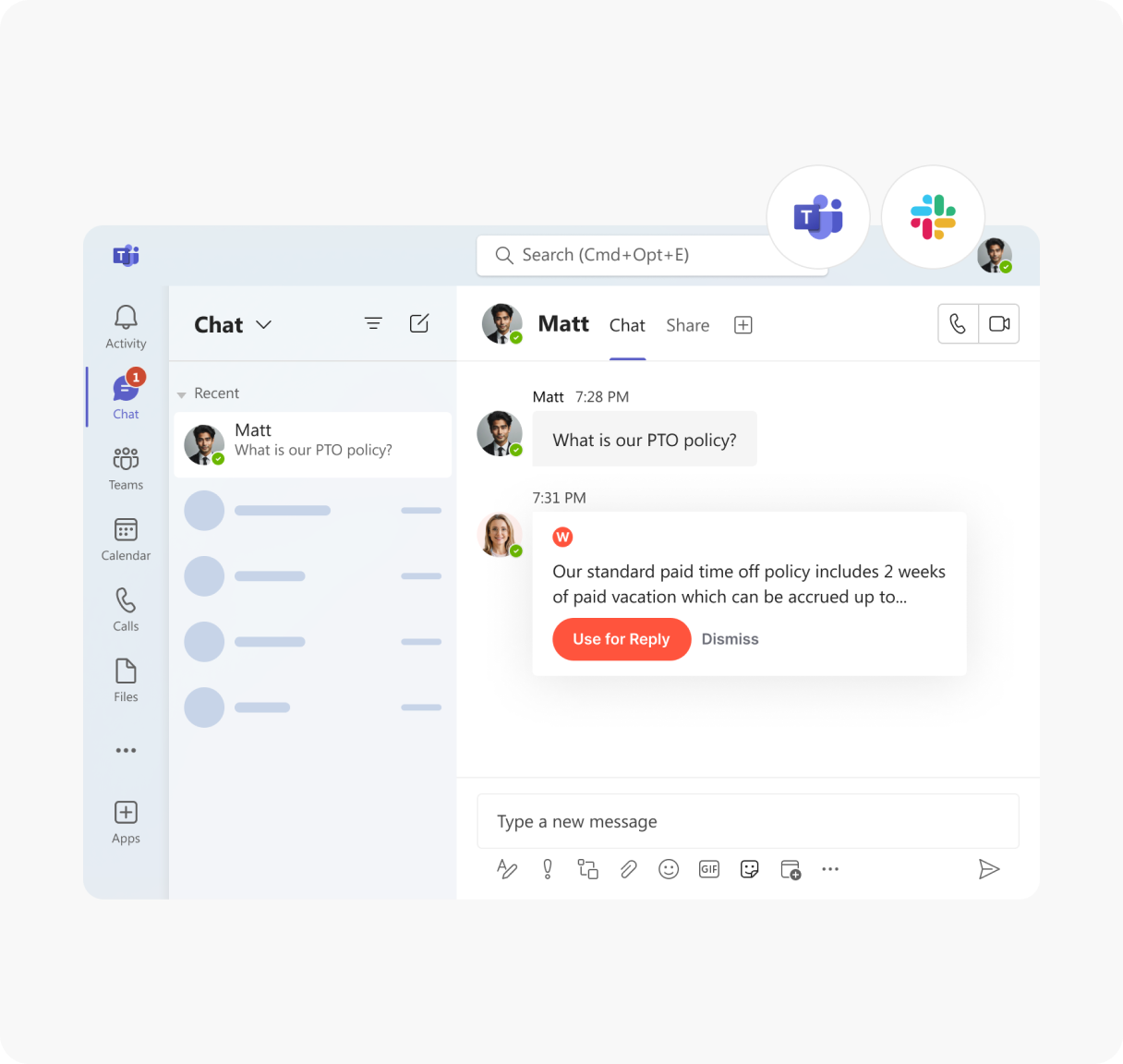

Managing retirement-related inquiries can be time-consuming, but Winslow, your AI-powered HR assistant, simplifies the process:

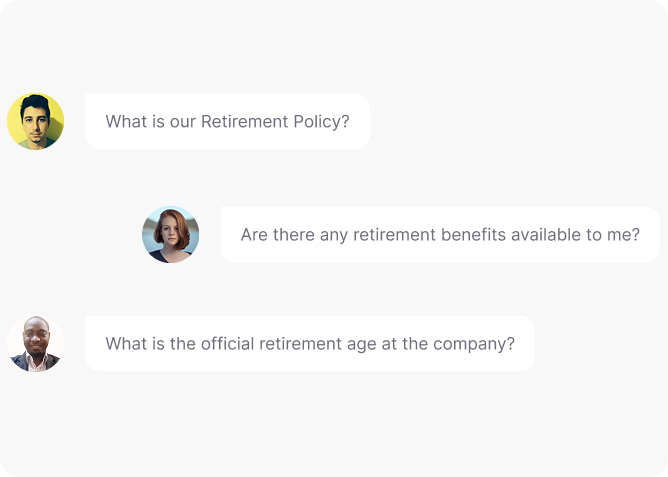

Instant answers anytime

Winslow ensures your Retirement Policy is always available on Slack, Teams, or email. Employees can instantly access information on eligibility, retirement benefits, 401(k) contributions, and pension plans—helping HR streamline retirement planning discussions.

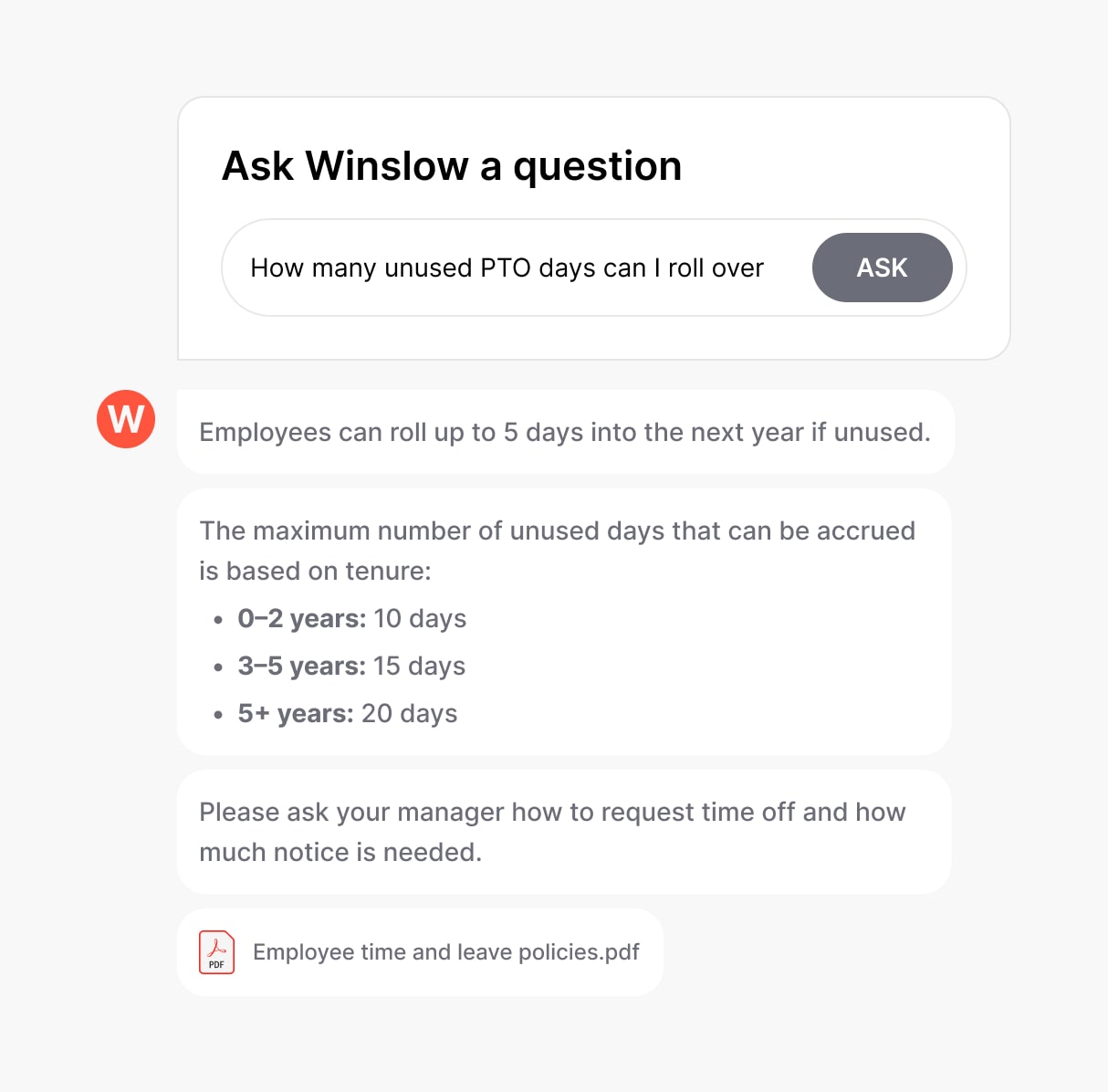

Personalized Support

Winslow instantly answers employee questions, including those about your Retirement Policy, ensuring clarity on contribution matching, withdrawal options, and retirement age requirements.

Analytics and Insights

Winslow tracks policy-related queries, helping HR teams identify trends and common concerns. This data enables organizations to refine their policy, improve reporting channels, and address recurring issues proactively.

Support Employees in Retirement Planning with Winslow

A clear retirement policy helps employees plan for their future with confidence. With Winslow, you can simplify policy communication, reduce HR workload, and enhance the employee experience.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

What is the standard retirement age for employees?

There is no mandatory age, but eligibility for retirement benefits typically begins at 62 under Social Security guidelines.

Can HR teams implement phased retirement programs?

Yes, structured plans allowing reduced hours and benefits continuity can support workforce transition.

Are retirees eligible for rehiring?

HR teams can implement return-to-work provisions based on business needs and IRS reemployment guidelines.

How should HR teams communicate financial planning resources?

By providing retirement counseling, workshops, and access to financial advisors.

What role does HR play in Social Security and pension coordination?

Offering guidance on benefit eligibility, payout structures, and retirement account withdrawals.

How should HR teams handle retiree healthcare benefits?

By outlining COBRA options, Medicare guidance, and company-sponsored retiree health plans.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more