Everything You Need to Know About Payment Policy

Clear payment guidelines help maintain financial transparency. A Payment Policy outlines salary disbursement schedules, payment methods, and compliance with wage laws, ensuring consistency and employee trust.

What is a Payment Policy?

A Payment Policy is an HR document that outlines payroll procedures, salary disbursement schedules, and methods of payment. It includes tax deductions, direct deposit options, and compliance with wage laws.

A transparent payment policy ensures employees receive their wages accurately and on time.

Guidelines for Creating a Payment Policy

A structured payment policy ensures timely and transparent compensation for employees while maintaining compliance with financial regulations. Here’s how to craft a strong policy:

Clearly Define Payment Structures

Specify salary components, including base pay, overtime, bonuses, and deductions.

Establish Payroll Schedules and Timelines

Outline bi-weekly, monthly, or other payment cycles to set expectations for employees.

Ensure Compliance with Wage Laws and Taxation

Align payment processes with minimum wage laws, overtime regulations, and tax deductions.

Provide Multiple Payment Methods

Offer direct deposit, physical checks, or digital payment options to accommodate employee preferences.

Outline Procedures for Payroll Discrepancies

Establish a process for employees to report payroll errors and ensure prompt resolution.

Regularly Review and Update Payment Policies

Adapt the policy to evolving labor laws, market trends, and company growth.

What is Covered in a Payment Policy?

An effective Payment Policy should include the following:

Payment Frequency and Methods

Define payroll cycles, payment modes (direct deposit, check, or digital transfer), and any flexibility in payments.

Overtime and Bonus Compensation

Explain how overtime is calculated and the eligibility criteria for bonuses, commissions, and incentives.

Tax Deductions and Compliance

Detail how taxes, benefits, and deductions are handled according to federal and state laws.

Salary Adjustment and Promotion Guidelines

Outline how and when salary reviews, raises, and role-based compensation changes occur.

Payroll Error Resolution Process

Establish steps employees can take if they encounter payment discrepancies and expected resolution times.

Final Paychecks and Exit Payments

Specify how terminated or resigning employees receive their final paycheck, including unpaid leave or severance pay.

Recordkeeping and Compliance Measures:

Explain how payroll records are maintained and audited to ensure accuracy and legal adherence.

Need help creating a Payment Policy?

How Winslow helps HR pros save time on responding to payment policy questions

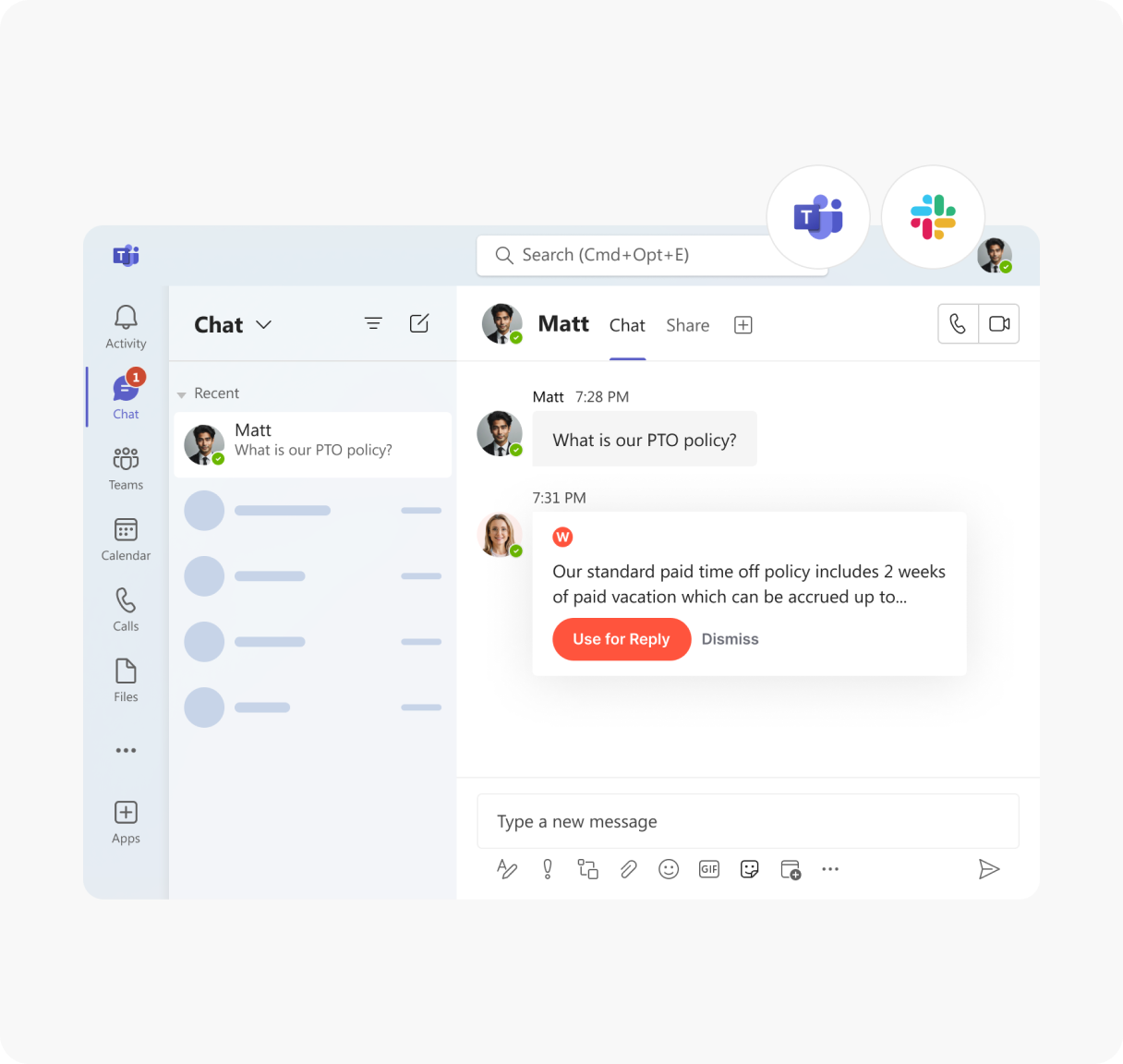

Managing payroll-related inquiries can be time-consuming, but Winslow, your AI-powered HR assistant, simplifies the process:

Instant answers anytime

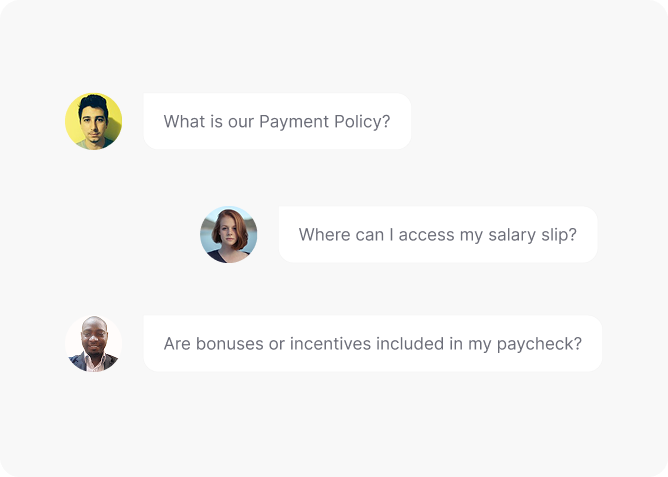

Winslow ensures your Payment Policy is always available on Slack, Teams, or email. Employees can instantly access information on payroll schedules, direct deposit setup, and payment methods—eliminating HR bottlenecks.

Personalized Support

Winslow instantly answers employee questions, including those about your Payment Policy, ensuring clarity on tax deductions, overtime pay, and paycheck discrepancies.

Analytics and Insights

Winslow tracks policy-related queries, helping HR teams identify trends and common concerns. This data enables organizations to refine their policy, improve reporting channels, and address recurring issues proactively.

Save Time on Payment Policies with Winslow

Payment-related inquiries can overwhelm HR, from payroll schedules to direct deposit setups. Winslow provides instant, accurate answers, ensuring employees always have access to payment policy details—without HR spending hours addressing common questions.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

How should HR ensure transparency in salary and wage calculations?

HR should provide detailed salary breakdowns in employment contracts, including base pay, deductions, overtime rates, and bonuses. Implementing self-service payroll portals allows employees to access payment details easily.

What should HR do to handle payroll discrepancies efficiently?

HR should establish a clear payroll dispute resolution process, requiring employees to report discrepancies within a defined period. A dedicated payroll team should review claims and provide resolution timelines.

How can HR ensure timely payroll processing across different employment types?

HR should use automated payroll systems with separate pay schedules for full-time, part-time, and contract workers, ensuring each category is paid on time per labor regulations.

How should HR communicate payment policy updates to employees?

HR should notify employees via official emails, employee handbooks, and payroll portal updates, ensuring a 30-day notice period before implementing any changes.

What steps should HR take to comply with legal payroll requirements?

HR should conduct annual compliance audits, stay updated on federal and state wage laws, and use payroll software with tax compliance features to avoid legal issues.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more