Everything You Need to Know About Overtime Policy

An overtime policy is crucial for any organization to ensure fair compensation for employees who work beyond their standard hours. It establishes clear guidelines on what constitutes overtime, the rate of compensation, and the approval process, protecting both the employer and the employees.

What is Overtime Policy?

An overtime policy outlines the rules and procedures regarding the payment of overtime for employees who work beyond their regular work hours. The policy typically defines what constitutes overtime, sets out the overtime pay rate, and provides a clear approval process for overtime work. It ensures that the organization complies with local, state, and federal labor laws regarding employee compensation, and helps prevent misunderstandings and disputes over pay.

Guidelines for Creating an Overtime Policy

By implementing a clear overtime policy, organizations can ensure fair compensation for extra hours worked while maintaining compliance with labor laws. Here’s how you can create a solid overtime policy:

Define Standard Working Hours

Clearly specify the regular work hours (e.g., 40 hours per week) to differentiate between standard and overtime hours.

Determine Overtime Pay Rate

Establish the overtime pay rate, typically 1.5 times the regular hourly rate for eligible employees, in accordance with labor laws.

Eligibility for Overtime

Define which employees are eligible for overtime compensation. Some employees may be exempt based on their job classification or salary level, so it’s important to specify who qualifies.

Overtime Approval Process

Set a process for employees to request and obtain approval for overtime hours. This may involve manager sign-off or submission through HR or payroll systems.

Tracking Overtime Hours

Implement a method for tracking overtime worked, whether through timekeeping software or manual reporting, to ensure accurate pay calculations.

Compliance with Labor Laws

Ensure that the policy aligns with all relevant labor laws regarding overtime compensation, including applicable minimum wage laws and rules around overtime in different jurisdictions.

What is Covered in an Overtime Policy?

An effective Overtime Policy should include the following

Overtime Rate

The policy should specify the overtime pay rate, which is often one-and-a-half times the standard hourly rate.

Overtime Threshold

Defines the number of hours employees can work before qualifying for overtime. For example, over 40 hours per week is typically considered overtime.

Exempt vs. Non-Exempt Employees

Clarifies which employees are exempt from overtime (typically salaried employees in certain managerial or professional roles) and which are non-exempt and eligible for overtime.

Overtime Approval Process

Outlines how employees can request overtime, how it should be tracked, and who must approve the overtime before it is worked.

Payment for Overtime

Details how and when overtime payments will be made and ensures compliance with legal requirements for overtime pay.

Recordkeeping

Specifies the importance of maintaining accurate records of overtime hours worked to ensure that employees are paid correctly and to comply with auditing requirements.

Need help creating a Overtime Policy?

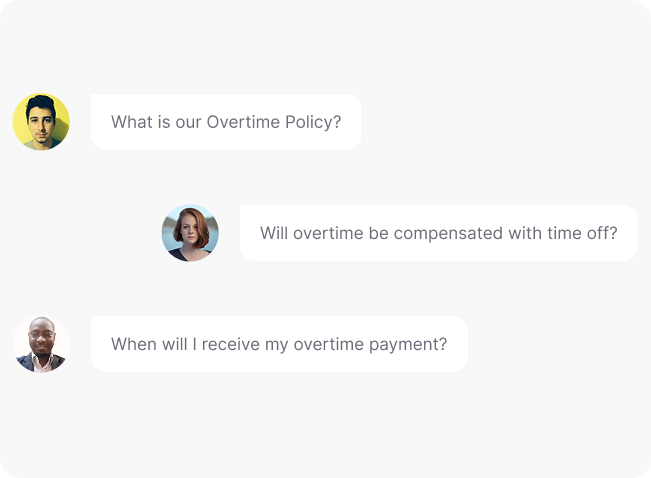

How Winslow Helps HR Teams Manage Overtime Questions with Ease?

Managing Overtime Inquiries Can Be Time-Consuming, But Winslow, Your AI-Powered HR Assistant, Simplifies the Process

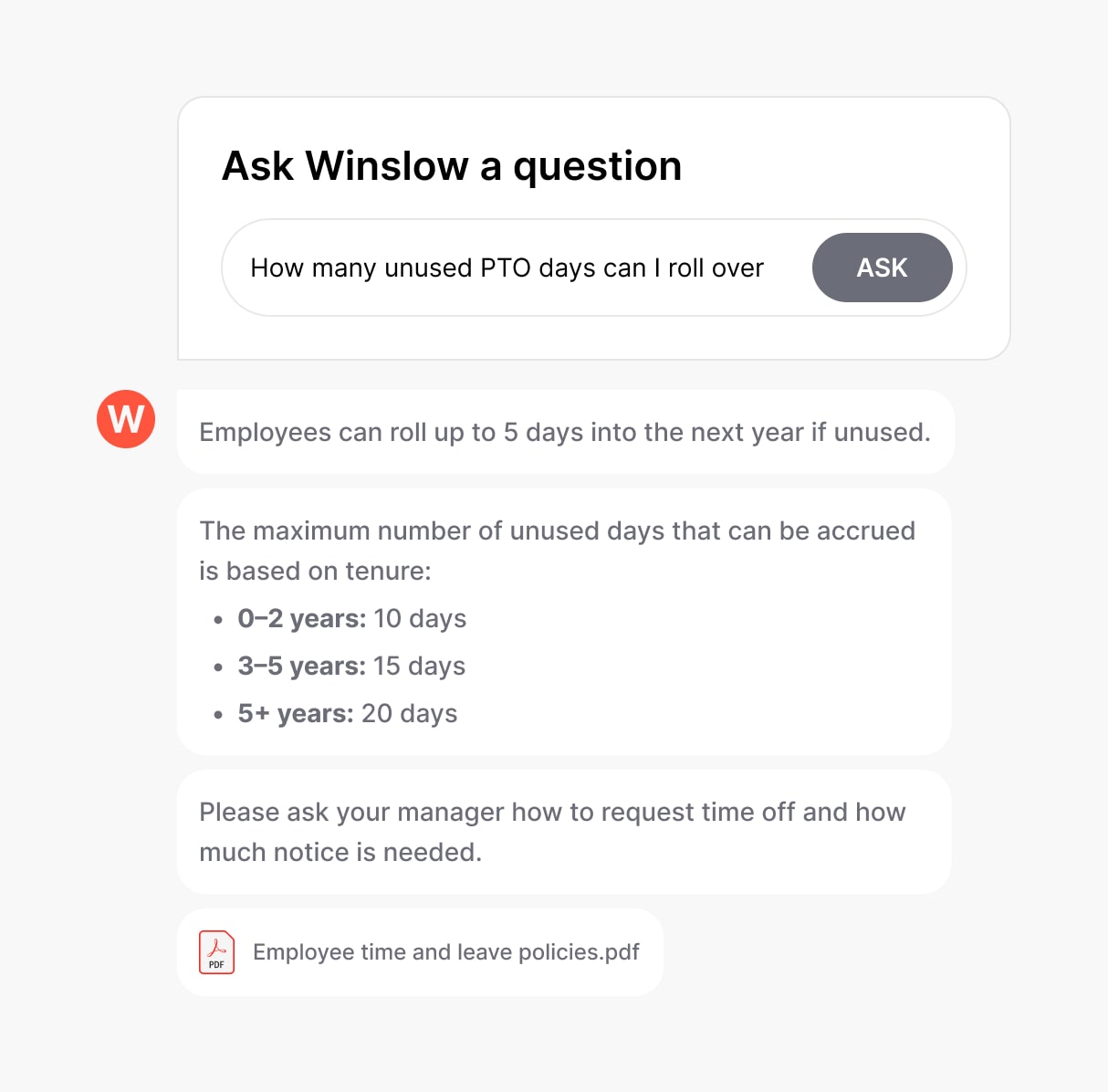

Instant answers anytime

Winslow ingests your overtime policy and responds to employee questions instantly on platforms like Slack, Teams, or email.”

Personalized Support

Winslow deliver instant, AI-powered answers to all HR questions, including those regarding your Overtime Policy, ensuring employees understand their rights and compensation for extra hours worked.

Analytics and Insights

Winslow tracks policy-related queries, helping you identify trends and areas where your policy might need improvement.

Cut the Time Spent on Overtime-Related Questions in Half

An efficient Overtime Policy ensures employees are compensated fairly and on time. Winslow takes care of tracking and responding to inquiries, simplifying HR tasks.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

How is overtime pay calculated?

Overtime pay is generally calculated at 1.5 times the employee’s regular hourly rate for hours worked beyond the standard 40 hours per week. Some jurisdictions may have different rules, so it’s essential to verify local labor laws.

Is overtime pay taxed differently?

Overtime pay is taxed at the same rate as regular wages, but depending on the total income for the pay period, employees may end up in a higher tax bracket due to the additional income.

Can overtime be accumulated over several weeks?

Overtime should generally be tracked on a weekly basis, especially if employees are working over 40 hours in a given week. Accumulating overtime over several weeks may not comply with labor laws, depending on your location.

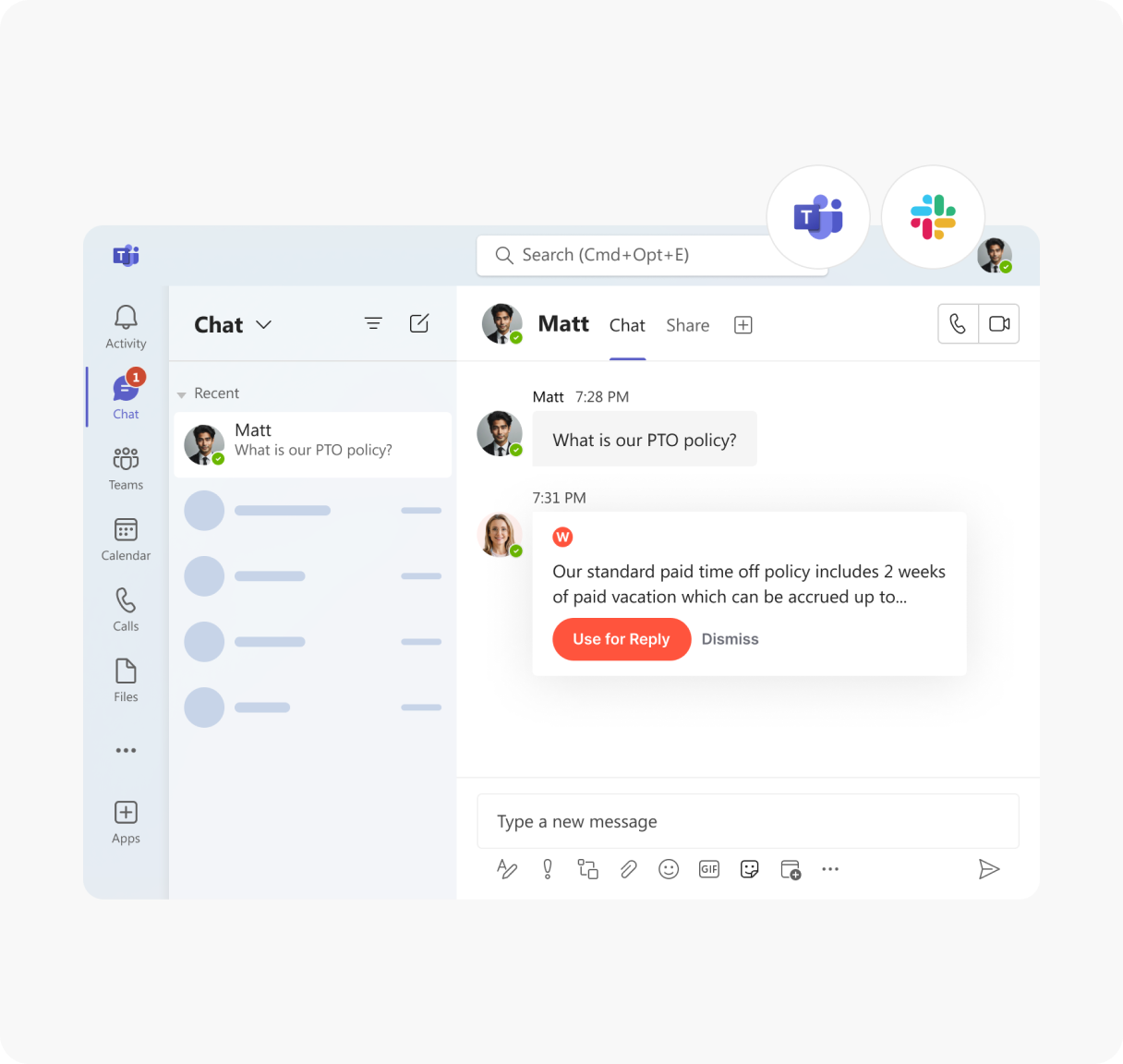

How does Winslow help with managing overtime policies?

Winslow can provide instant answers about your company’s overtime policies by analyzing the rules within your documents and employee guidelines, helping you ensure compliance and streamline your HR processes.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more