Everything You Need to Know About Expense Reimbursement Policy

An expense reimbursement policy is a critical component of any organization’s financial management framework. It ensures employees are fairly compensated for legitimate expenses incurred while performing work-related activities, promoting transparency, accountability, and financial clarity.

What is an Expense Reimbursement Policy?

An expense reimbursement policy outlines the procedures and guidelines employees must follow to claim reimbursement for business-related expenses. This policy specifies the types of expenses eligible for reimbursement, documentation requirements, submission timelines, and approval processes. A well-defined policy ensures compliance with company standards and reduces the risk of disputes or financial mismanagement.

Guidelines for Creating an Expense Reimbursement Policy

Crafting a robust expense reimbursement policy involves addressing key aspects of the reimbursement process to ensure fairness and operational efficiency:

Define Eligible Expenses

Specify the categories of expenses eligible for reimbursement, such as travel, meals, lodging, client entertainment, office supplies, and training costs.

Set Spending Limits

Establish limits for specific expense categories (e.g., daily meal allowances, maximum hotel rates) to control costs while accommodating reasonable spending.

Outline Submission Procedures

Describe the steps employees must follow to submit reimbursement requests, including the use of expense reporting tools or forms.

Clarify Documentation Requirements

Specify the supporting documents required for reimbursement, such as original receipts, invoices, or mileage logs.

Define Timelines

Establish deadlines for submitting expense claims (e.g., within 30 days of incurring the expense) to maintain timely processing.

Implement an Approval Process

Detail the approval hierarchy for expense claims, ensuring accountability and adherence to policy guidelines.

What is Covered in an Expense Reimbursement Policy?

An effective expense reimbursement policy should include the following:

Eligible Expenses

Examples include transportation (e.g., airfare, taxi fares, mileage), accommodation, meals, professional development, and work-related supplies.

Submission Guidelines

Clear instructions for filling out expense reports, including deadlines and acceptable formats for documentation.

Approval Workflow

Details on who must approve reimbursement requests and the timeline for approvals.

Reimbursement Timeline

Information on when employees can expect to receive their reimbursement (e.g., within two weeks of approval).

Policy Violations

Consequences for submitting false claims or failing to comply with policy requirements.

Special Provisions

Guidelines for extraordinary expenses requiring prior approval or exceptions to standard policies.

Payment Methods and Limits

Define acceptable payment methods (e.g., company card, personal funds) and set spending limits for different expense categories.

Tax and Compliance Requirements

Specify tax implications, receipt retention policies, and compliance with local financial regulations.

Non-Reimbursable Expenses

List expenses that are not covered, such as personal entertainment, luxury accommodations, or non-work-related purchases.

Need help creating a Expense Reimbursement Policy?

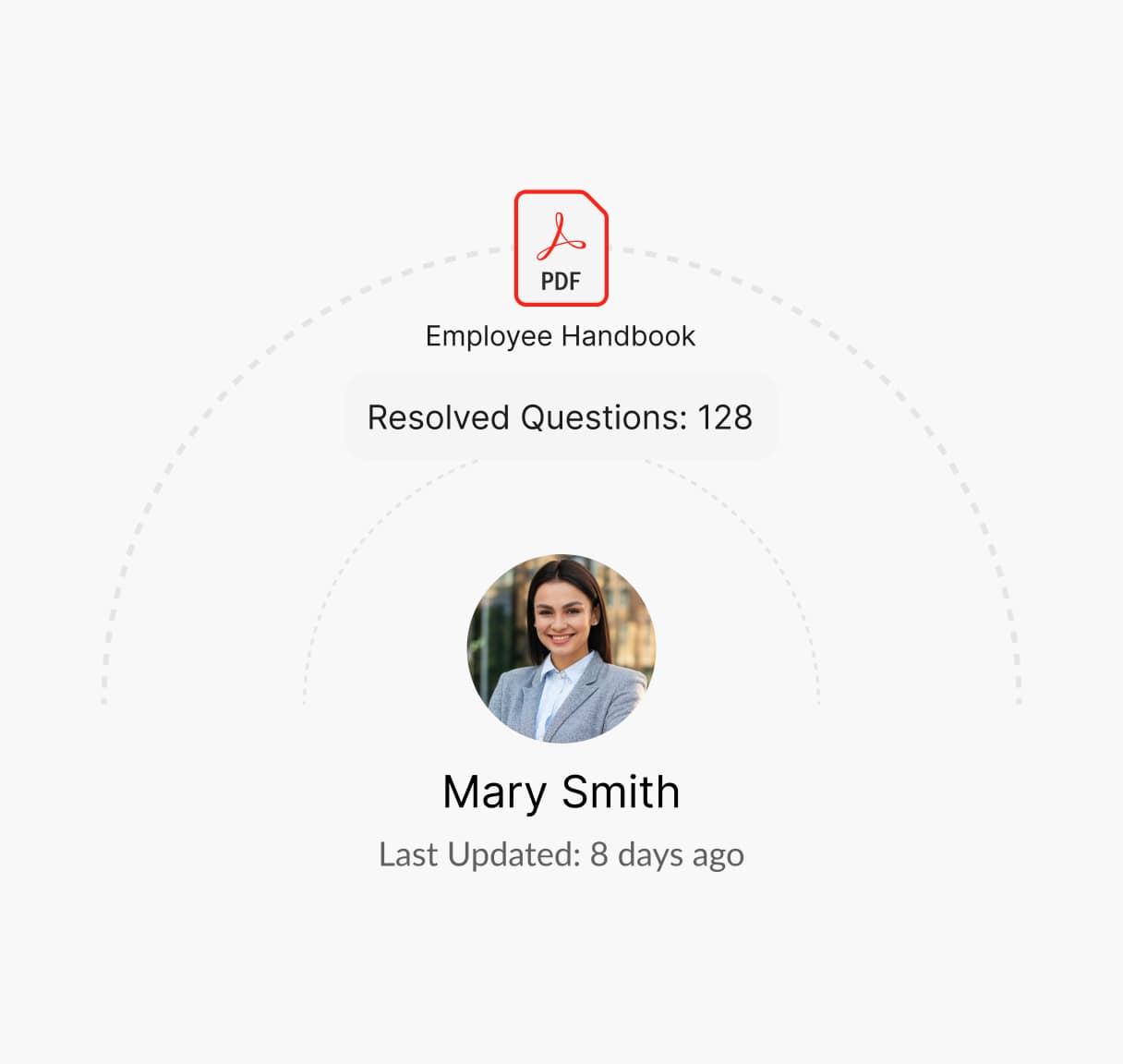

How Winslow Helps HR Teams Simplify Expense Reimbursement Policies

Managing expense reimbursements effectively requires a balance of clarity, efficiency, and compliance. Winslow’s AI-powered solutions make this process seamless:

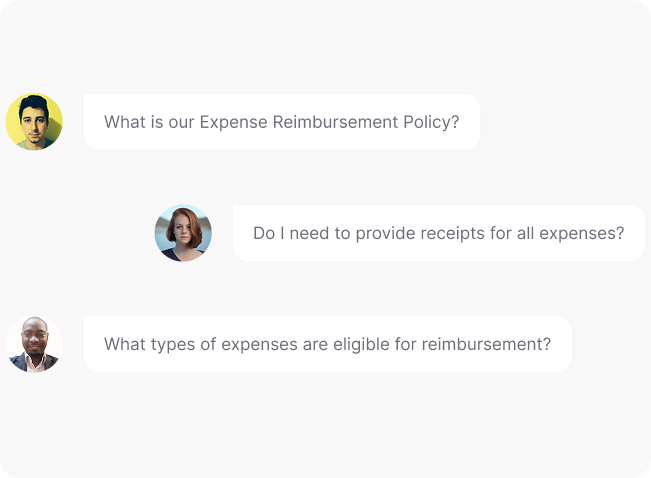

Instant answers anytime

Winslow enables employees to access the expense reimbursement policy instantly through Slack, Teams, or email. They can find details about eligible expenses, submission timelines, or documentation requirements without waiting for HR assistance.

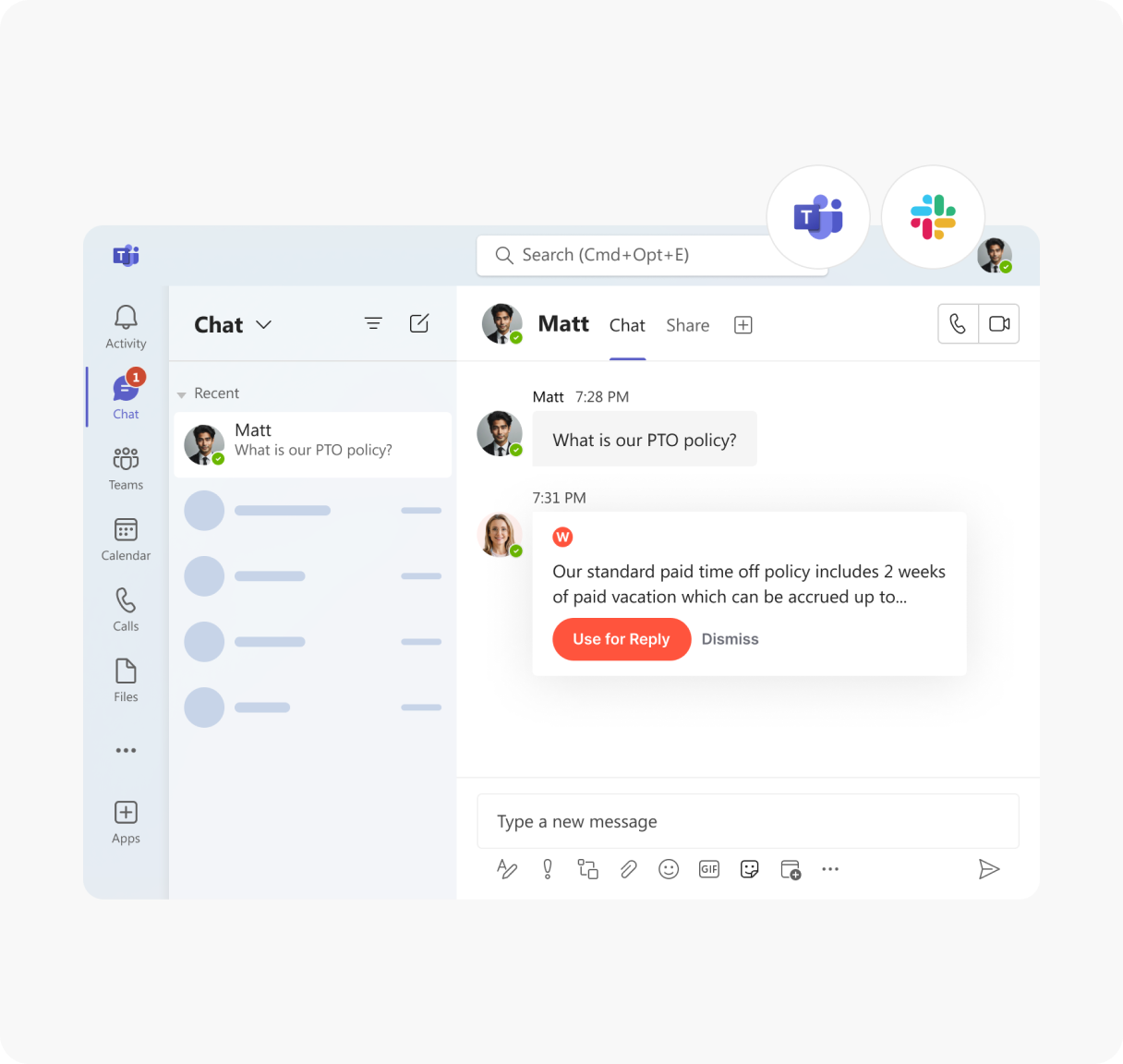

Personalized Support

Winslow provides instant answers to all HR questions, including those about your Expense Reimbursement Policy, ensuring clarity on eligible expenses and the reimbursement process.

Analytics and Insights

Winslow tracks policy-related queries, helping HR teams identify trends and common concerns. This data enables organizations to refine their policy, improve reporting channels, and address recurring issues proactively.

Streamline Expense Reimbursement Queries for HR Teams with Winslow

Winslow empowers HR teams to manage expense reimbursement policies efficiently, ensuring quick responses to employee queries and fostering financial transparency. Enhance compliance, reduce workload, and boost employee satisfaction with Winslow’s AI-powered solutions.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

What types of expenses are eligible for reimbursement?

Eligible expenses typically include transportation, lodging, meals, office supplies, and costs related to professional development. Refer to your organization’s policy for specific details.

What happens if an employee submits incomplete documentation?

Incomplete documentation may delay reimbursement. Employees will be asked to provide the missing information or receipts before their claim can be processed.

Are there spending limits for specific expense categories?

Yes, most organizations set limits for categories like meals, lodging, and transportation to ensure reasonable spending. Check your policy for the applicable limits.

Can employees request reimbursement for personal expenses?

No, personal expenses are generally not eligible for reimbursement. The policy will outline non-reimbursable expenses explicitly.

How long does it take to process reimbursement claims?

Reimbursement timelines vary by organization but are typically processed within two weeks of receiving a complete and approved expense claim.

Does the policy cover international travel expenses?

Yes, but international travel expenses may require additional documentation or prior approval. Refer to the policy for specific guidelines.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more