Everything You Need to Know About Claim Reimbursement

Employees should have a straightforward process for recovering business expenses. A Claim Reimbursement Policy defines eligible expenses, submission procedures, and approval timelines, ensuring fairness and efficiency.

What is a Claim Reimbursement?

A Claim Reimbursement Policy is an HR document that details the process for employees to request reimbursement for work-related expenses. It includes eligible expenses, submission procedures, and approval timelines.

A structured reimbursement policy ensures fairness, compliance, and financial accountability.

Guidelines for Creating a Claim Reimbursement

A clear and structured claim reimbursement policy ensures employees are promptly compensated for eligible expenses while maintaining financial accountability. Here’s how to develop an effective policy:

Define Eligible and Non-Eligible Expenses

Specify reimbursable costs, such as travel, work-related supplies, or medical claims, and clarify restrictions.

Establish Submission Deadlines and Requirements

Set clear timelines for claim submission and necessary supporting documentation.

Outline Approval and Verification Processes

Detail the steps required for review, manager approval, and finance department verification.

Provide Multiple Reimbursement Methods

Offer reimbursement via direct deposit, payroll adjustment, or expense accounts for convenience.

Ensure Compliance with Tax and Accounting Laws

Align the policy with IRS regulations and company financial policies to maintain compliance.

Implement a Tracking and Audit Mechanism

Maintain expense records and review patterns to prevent fraudulent claims and improve policy efficiency.

What is Covered in a Claim Reimbursement?

An effective Claim Reimbursement should include the following:

Types of Reimbursable Expenses

Clearly outline categories such as travel, work-related meals, training, office supplies, and health expenses.

Claim Submission Process and Deadlines

Provide a step-by-step guide for employees to submit claims and supporting receipts.

Approval and Review Workflow

Specify who reviews and approves claims, including the role of HR and finance teams.

Payment Processing and Timelines

Set expectations for reimbursement processing times (e.g., within 14 business days).

Limits and Caps on Reimbursements

Define spending limits per category, including per diem rates and mileage allowances.

Tax Compliance and Recordkeeping

Explain how tax reporting is handled for reimbursed expenses and how long records are retained.

Appeal Process for Denied Claims

Provide a procedure for employees to dispute denied reimbursements and request reconsideration.

Need help creating a Claim Reimbursement?

How Winslow helps HR teams save time on responding to claim reimbursement policy questions

Managing reimbursement inquiries can be time-consuming, but Winslow, your AI-powered HR assistant, simplifies the process:

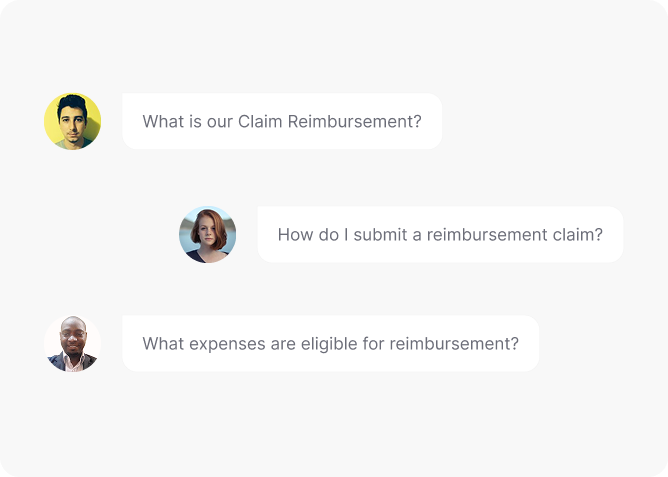

Instant answers anytime

Winslow ensures your Claim Reimbursement Policy is always available on Slack, Teams, or email. Employees can instantly find details on eligible expenses, submission procedures, and approval timelines—minimizing back-and-forth with HR.

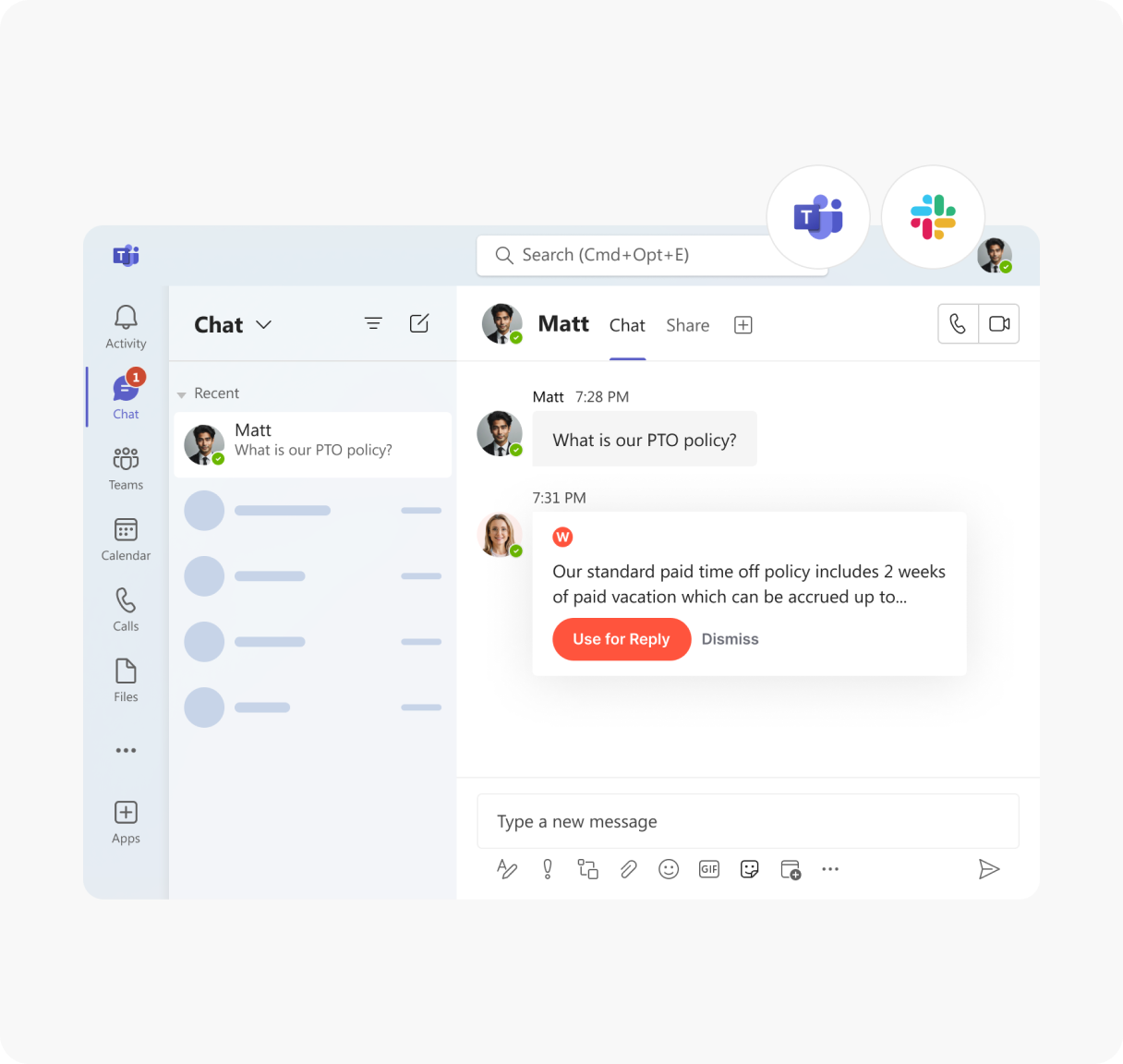

Personalized Support

Winslow instantly answers employee questions, including those about your Claim Reimbursement Policy, ensuring clarity on travel, healthcare, and professional development reimbursements.

Analytics and Insights

Winslow tracks policy-related queries, helping HR teams identify trends and common concerns. This data enables organizations to refine their policy, improve reporting channels, and address recurring issues proactively.

Save Time Managing Claim Reimbursement Policies with Winslow

Employees frequently ask about reimbursement processes, from submission deadlines to approval timelines. Winslow delivers instant, policy-compliant responses, reducing HR workload while ensuring employees get the clarity they need.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

How should HR define reimbursable expenses to avoid confusion?

HR should create a detailed reimbursement policy outlining eligible expenses (e.g., travel, meals, home office equipment) and non-reimbursable costs. Pre-approval processes for high-cost claims prevent disputes.

What system should HR use to streamline reimbursement requests and approvals?

HR should implement expense management software where employees can submit digital claims, attach receipts, and track approval status in real time.

What is the ideal timeline for processing reimbursements?

HR should acknowledge claims within 2 business days, approve or reject within 7-10 days, and process payments within 15 business days to ensure efficiency.

How should HR prevent fraudulent reimbursement claims?

HR should conduct random audits, require itemized receipts, and implement managerial approval for high-value claims to maintain integrity in the reimbursement process.

How can HR ensure employees understand the reimbursement process?

HR should provide step-by-step guides, conduct quarterly training sessions, and have a designated support team to assist with reimbursement queries.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn morepayment policy

Ensuring timely and fair compensation is essential. A clear Payment Policy outlines...

Learn more