Everything You Need to Know About Salary and Compensation Policy

This policy helps HR teams define pay structures, maintain internal equity, retain employees and stay compliant with legal requirements, ensuring employees feel valued and motivated.

What is a Salary and Compensation Policy?

A salary and compensation policy is a document that outlines an organization’s approach to employee remuneration. It includes details on pay structures, incentives, benefits, and guidelines for salary reviews. This policy ensures that compensation practices align with market standards, organizational goals, and employee performance, fostering trust and reducing turnover.

Guidelines for Creating a Salary and Compensation Policy

Clear guidelines help align pay structures with organizational goals, fostering trust and transparency. Here’s how you can develop an effective salary and compensation policy:

Research Market Data

Benchmark salaries and benefits against industry standards to stay competitive.

Develop Pay Structures

Establish pay grades, bands, or scales based on job roles, seniority, and skill levels.

Incorporate Incentives

Outline bonus structures, commission plans, or profit-sharing schemes to reward performance.

Ensure Legal Compliance

Adhere to local labor laws, minimum wage requirements, and tax regulations.

Establish Review Processes

Define how and when salary adjustments or promotions will be reviewed.

Total Rewards and Benefits

Define the full compensation package, including health insurance, retirement plans, stock options, and other non-monetary perks that contribute to overall employee satisfaction and retention.

What is Covered in a Salary and Compensation Policy?

An effective Salary and Compensation Policy should include the following

Compensation Philosophy

The guiding principles behind the organization’s pay practices, such as merit-based or market-driven approaches.

Pay Structure

Detailed breakdowns of salary bands, grades, and ranges for different roles and levels.

Incentive Programs

Guidelines for bonuses, stock options, or other performance-based rewards.

Allowances and Benefits

Additional perks, such as transportation allowances, housing stipends, or health benefits.

Salary Review Process

Timelines and criteria for performance appraisals, salary adjustments, and promotions.

Overtime Pay and Deductions

Policies for overtime compensation and permissible deductions from wages.

Legal Compliance

References to labor laws, equal pay regulations, and tax obligations.

Need help creating a Salary and Compensation Policy?

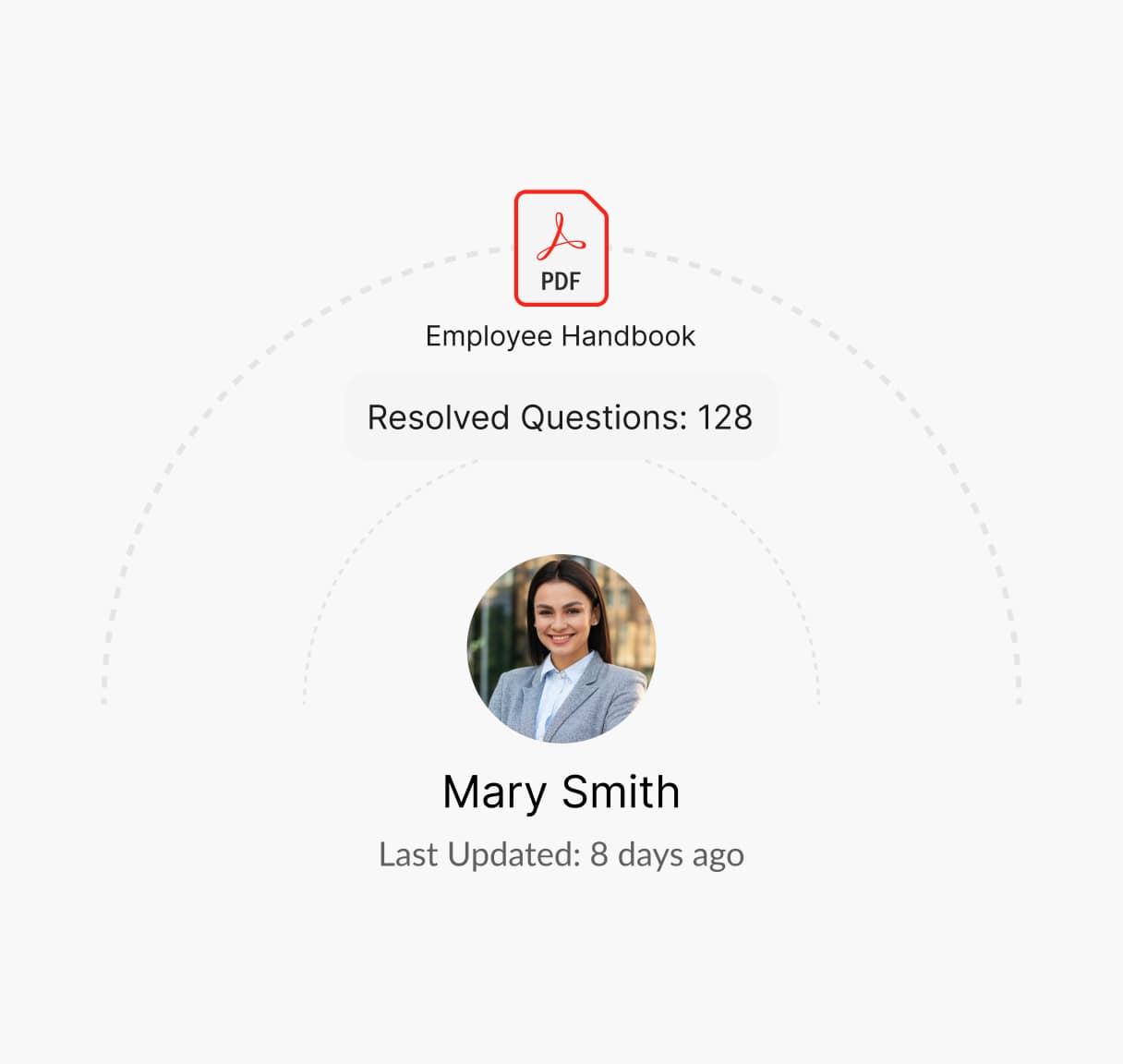

How Winslow Helps HR Teams Manage Salary and Compensation Questions with Ease?

Winslow, is an AI-powered HR assistant, that simplifies salary and compensation management while supporting your workforce with these features:

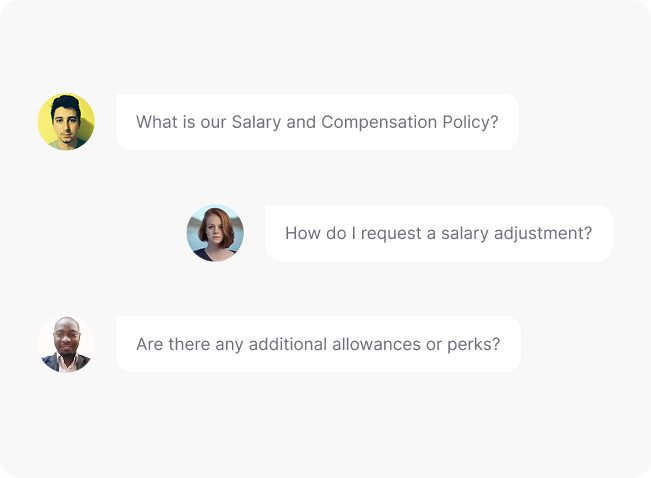

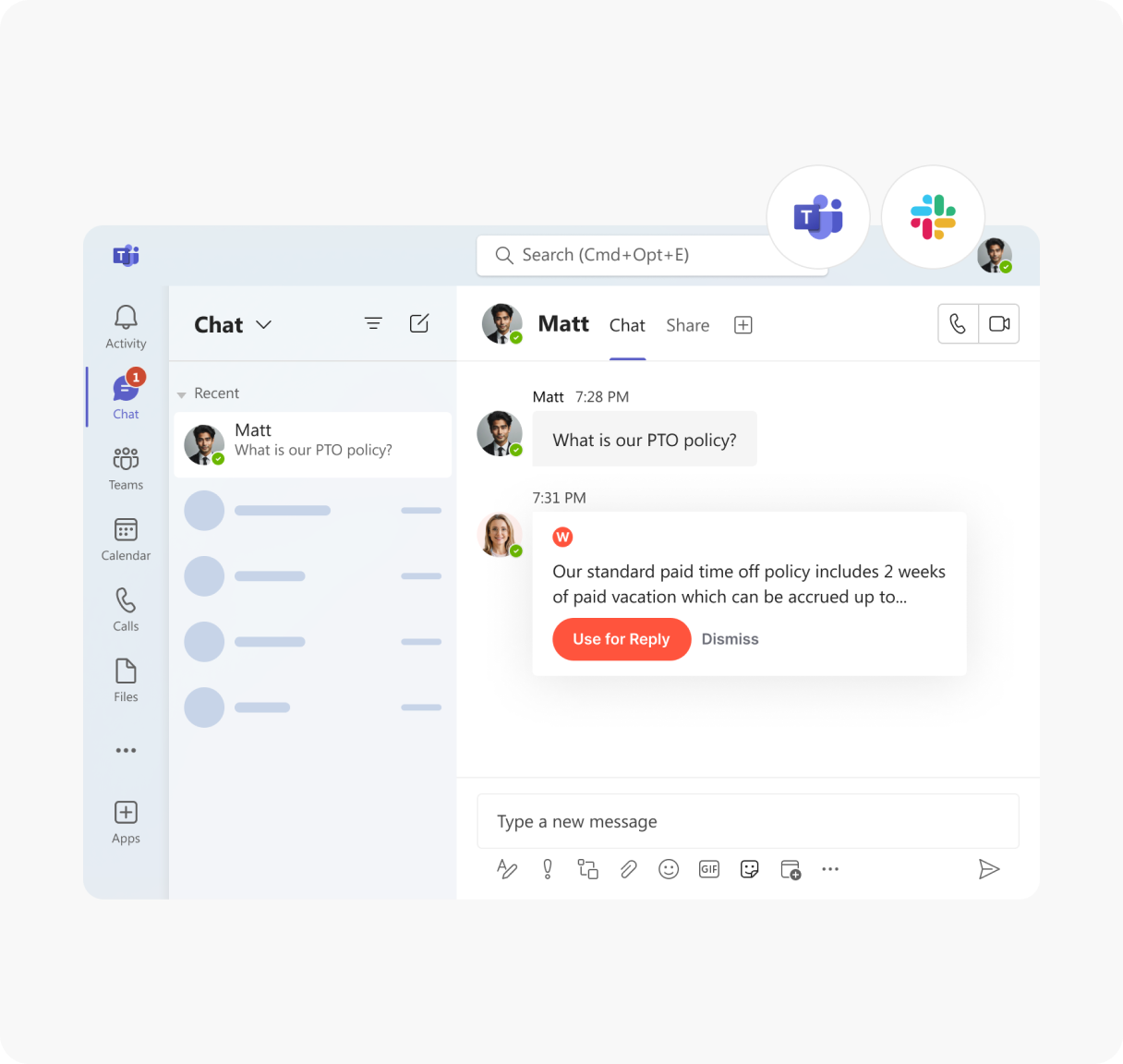

Instant Answers Anytime

Winslow ingests your salary and compensation policy to quickly answers employee questions instantly on tools like Slack, Teams, and email.

Personalized Support

Winslow offers instant, AI-powered answers to all HR questions, including those about your Salary and Compensation Policy, ensuring transparency and clarity on pay structures and benefits.

Analytics and Insights

Winslow tracks policy-related queries, helping you identify trends and areas where your policy might need improvement.

Cut the Time Spent on Salary Questions in Half

Ensure your employees have all the answers about pay, bonuses, and benefits—without the HR bottleneck. Winslow has you covered.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

What are salary adjustments, and how are they determined?

Salary adjustments refer to changes in an employee’s pay and can be based on:

– Performance evaluations and merit increases.

– Promotions or changes in job responsibilities.

– Market adjustments to remain competitive.

– Annual cost-of-living adjustments (COLA).

How is pay transparency addressed in a salary and compensation policy?

Pay transparency can be addressed by:

– Communicating how salaries are determined and aligned with organizational goals.

– Providing clear salary ranges for roles during recruitment.

– Ensuring compliance with legal requirements, such as pay equity laws.

How often should salaries be reviewed?

Salaries should be reviewed:

– Annually, as part of the performance review cycle.

– Periodically, to stay competitive with market benchmarks.

– During organizational restructuring or significant economic changes

What is unfair salary compensation?

Unfair salary compensation occurs when employees are paid inequitably for similar roles, skills, and experience. This can result from biases, lack of transparency, or failure to comply with equal pay laws. It can lead to employee dissatisfaction, reduced productivity, and potential legal disputes.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more