Everything You Need to Know About Employee Benefits Policy

An Employee Benefits Policy is crucial for attracting and retaining top talent while supporting employee well-being. It defines the benefits offered by an organization, fostering transparency, enhancing job satisfaction, and cultivating a positive workplace culture.

What is an Employee Benefits Policy?

An Employee Benefits Policy outlines the various benefits provided by an organization to its employees. These benefits may include health insurance, retirement plans, paid time off, wellness programs, and additional perks. The policy sets clear guidelines on eligibility, enrollment, and usage, ensuring employees understand what they are entitled to and how to access those benefits. By aligning with legal and industry standards, this policy ensures fairness and transparency while promoting employee satisfaction.

Guidelines for Creating an Employee Benefits Policy

By outlining eligibility, coverage, and enrollment procedures, organizations can ensure that benefits are communicated clearly and consistently. Here’s how you can develop a strong employee benefits policy:

Assess Employee Needs

Conduct surveys or feedback sessions to identify which benefits employees value most.

Define Eligibility Criteria

Clearly specify who qualifies for certain benefits based on factors like employment status, tenure, or role.

Detail Offered Benefits

Include specifics about health insurance, retirement plans, leave policies, and other perks.

Ensure Legal Compliance

Align the policy with local labor laws, tax regulations, and industry standards.

Provide Clear Communication

Use accessible language to explain benefits and the enrollment process.

Review and Update Regularly

Periodically evaluate the policy to ensure it remains competitive and relevant.

What is Covered in an Employee Benefits Policy?

An effective Employee Benefits Policy should include the following

Health and Wellness Benefits

Coverage details for health insurance, dental and vision plans, and wellness programs.

Retirement Plans

Information on 401(k) options, employer contributions, and vesting schedules.

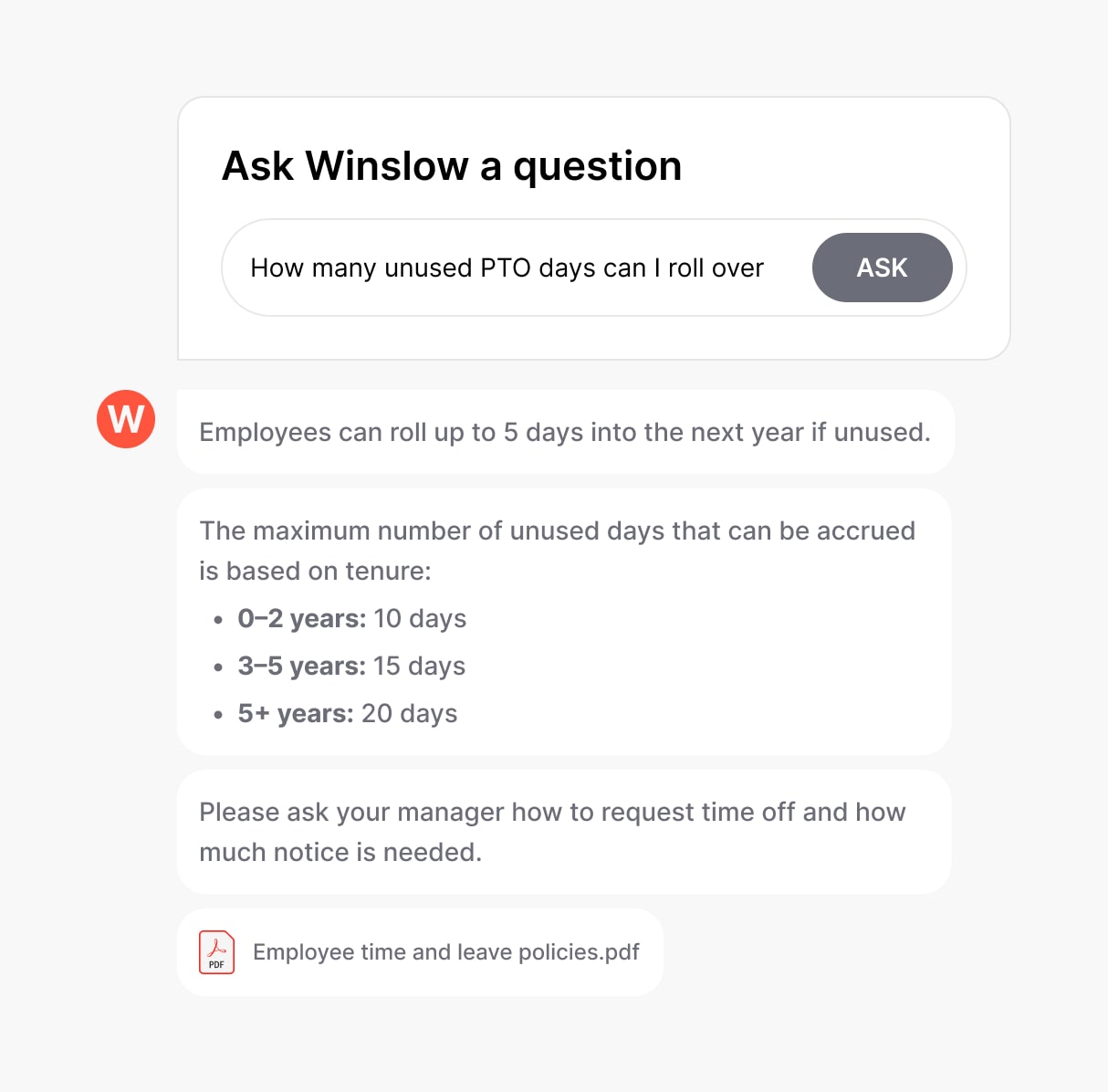

Paid Time Off (PTO)

Policies for vacation, sick leave, parental leave, and holidays.

Flexible Work Arrangements

Options for remote work, flexible hours, or compressed workweeks.

Employee Assistance Programs (EAPs)

Confidential services like counseling and financial advice.

Professional Development

Details about tuition reimbursement and training opportunities.

Additional Perks

Examples include transportation subsidies, gym memberships, or employee discounts.

Eligibility and Enrollment

Clear guidelines on accessing and enrolling in benefits.

Legal and Compliance Notes

Alignment with relevant laws and regulations.

Need help creating a Employee Benefits Policy?

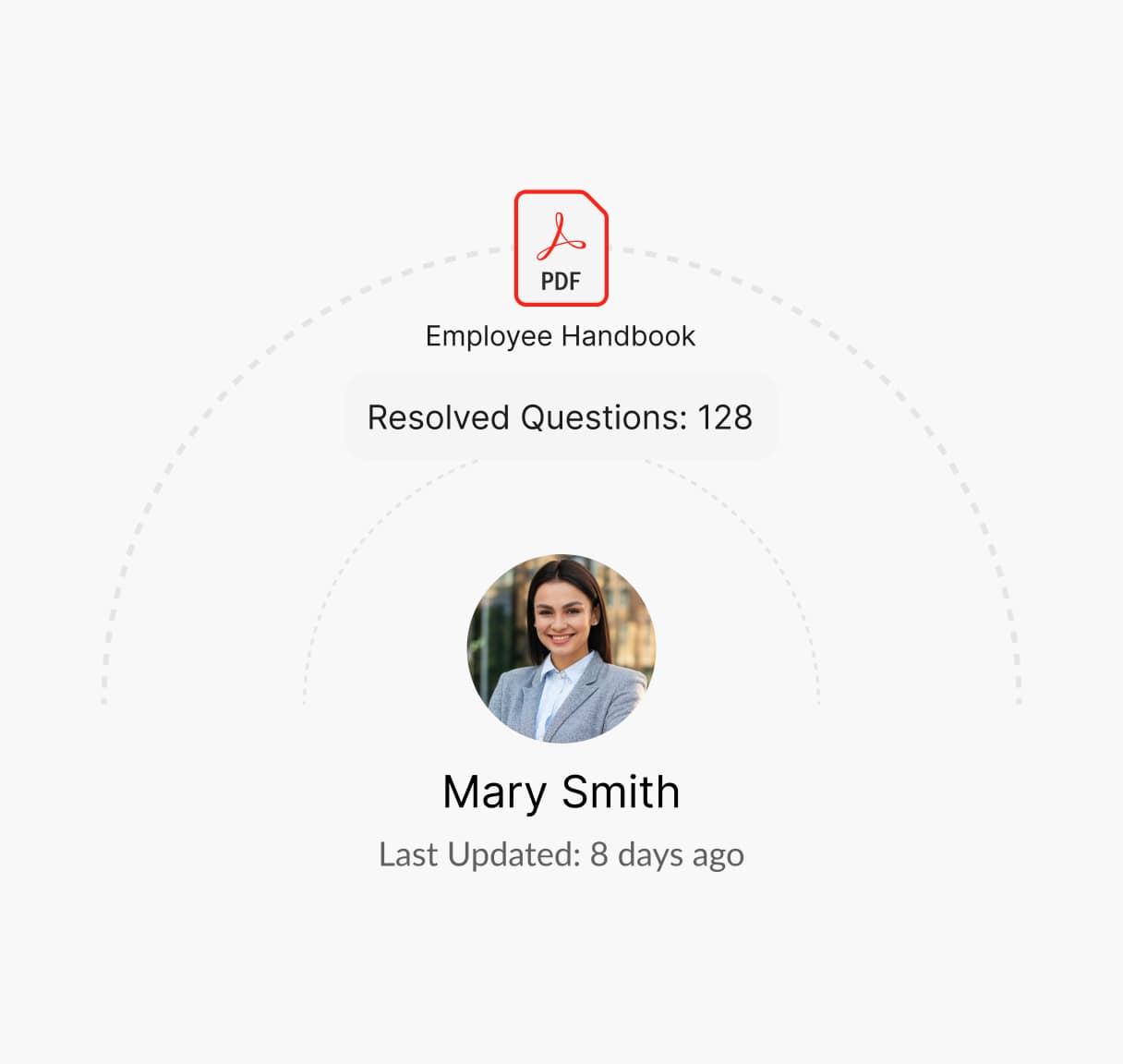

How Winslow Helps HR Teams Save Time on Responding to Employee Benefits-Related Questions

Winslow, is an AI-powered HR assistant, that simplifies policy management while supporting your workforce with these features:

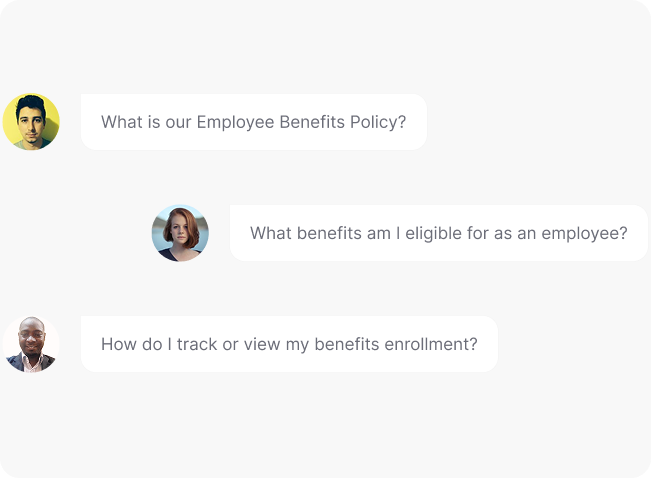

Instant answers anytime

Winslow ingests your employee benefit policy to quickly answers employee questions instantly on tools like Slack, Teams, and email.

Personalized Support

Winslow provides immediate, AI-driven answers to all HR queries, including those related to your Employee Benefits Policy, ensuring employees have easy access to benefit details and eligibility.

Analytics and Insights

Winslow tracks policy-related queries, helping you identify trends and areas where your policy might need improvement.

Take the Hassle Out of Benefits Management with Winslow

Winslow ensures your Employee Benefits Policy is clear, accessible, and hassle-free. Empower employees with instant answers while HR saves time on repetitive tasks.

Frequently asked questions

Have further questions about Winslow, contact us at sales@usewinslow.com

What is the difference between mandatory and voluntary benefits?

Mandatory benefits, such as Social Security contributions or unemployment insurance, are required by law. Voluntary benefits, like gym memberships or educational assistance, are offered at the company’s discretion.

Can benefits coverage change after enrollment?

Yes, coverage can change due to qualifying life events such as marriage, childbirth, or loss of existing coverage. Employees should notify HR and follow the policy guidelines.

How can employees learn more about their benefits?

Employees can consult the Employee Benefits Policy, contact HR, or use Winslow to get instant answers to their questions.

Which of the following is legally required of employee benefits policies?

Legally required benefits typically include Social Security and Medicare contributions, unemployment insurance, workers’ compensation, family and medical leave (FMLA), and health insurance for employers with 50+ employees under the ACA. Compliance with local labor laws and tax regulations is also mandatory.

Additional resources

Device Usage Policy

Managing employee leave effectively is vital for maintaining workforce productivity and compliance....

Learn moreconfidentiality policy

Protecting sensitive information is crucial. A clear Confidentiality Policy outlines guidelines for...

Learn moreclaim reimbursement

Ensuring fair compensation for expenses is key. A clear Claim Reimbursement Policy...

Learn more